portland oregon sales tax 2021

This is in addition to the three new measures passed in November 2020 and the usual 3 increase Portland homeowners see every year. Marginal tax rates start at 475 percent and as a taxpayers income goes up rates quickly rise to 675 percent and 875 percent topping out at 99 percent.

20 Honest Pros And Cons Of Living In Portland Oregon Tips

Following is an overview of.

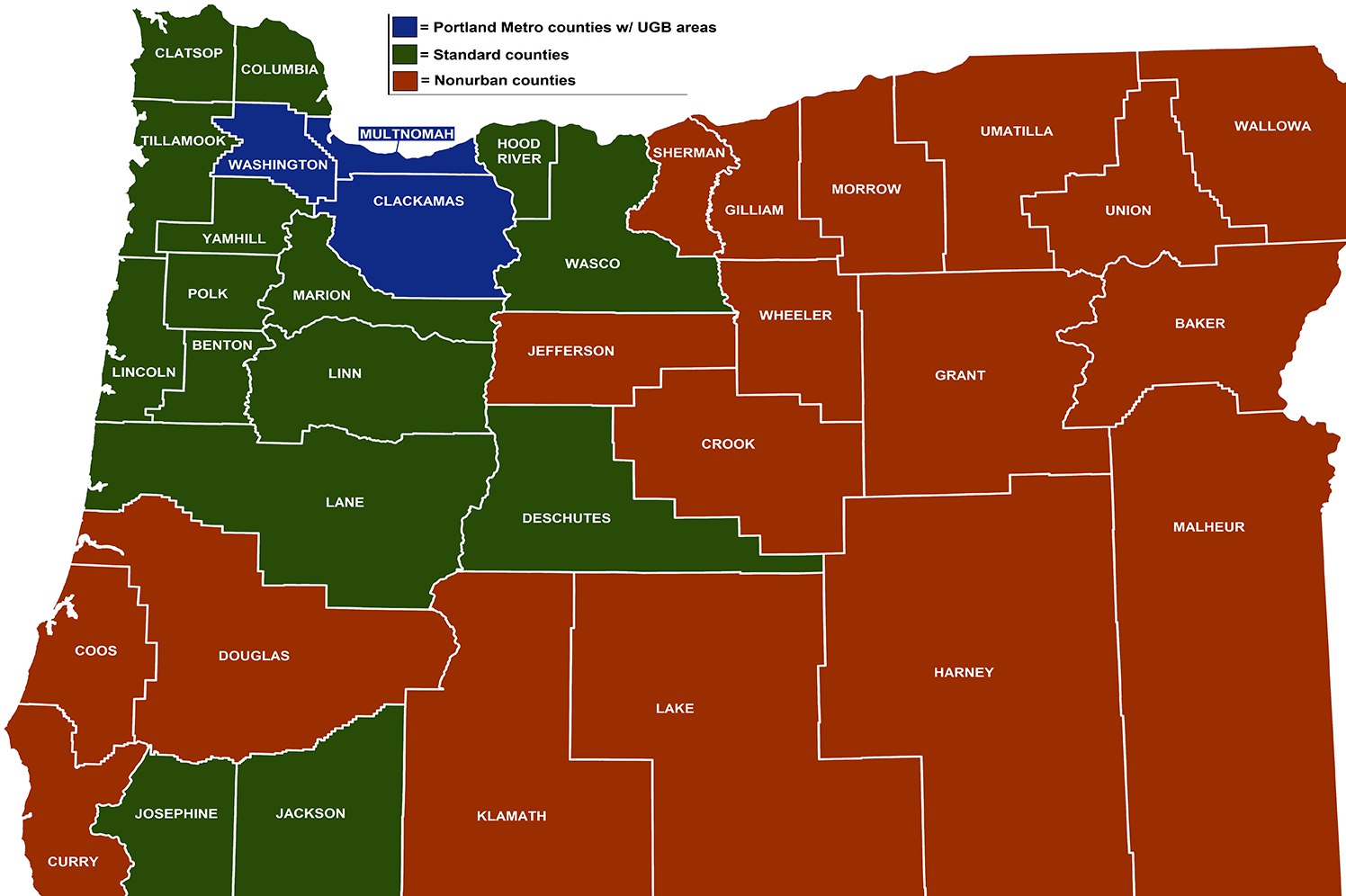

. Effective January 1 2021 two new Oregon local income taxes apply the Portland Metro Supportive Housing Services Income Tax and the Multnomah County Preschool for All Income TaxBeginning April 2021 employers are able to remit withholding tax payments and file returns for these new local taxes through the Portland Revenue Division. Valley region of the Pacific Northwest at the confluence of the Willamette and Columbia rivers in Northwestern Oregon. The thing to note is that it doesnt take much income to get to the next-to-highest tax bracket of 875 percent.

The Oregon sales tax rate is currently. TAX DAY NOW MAY 17th - There are -374 days left until taxes are due. I understand their is no sales tax in Oregon on everything.

Among major cities Tacoma Washington imposes the highest combined state and local sales tax rate at 1030 percent. Portland Property Taxes Going Up in 2022. Certain business activities are exempt from paying business taxes in Portland andor Multnomah County.

100 Working Portland sales tax calculator Updated 2021 and providing the best and accurate results you can get non other than on 360 taxes. Answer 1 of 14. Oregon OR Sales Tax Rates by City A The state sales tax rate in Oregon is 0000.

For the tax years beginning on or after January 1 2020 this tax is 3 percent of the total Oregon Weight-Mile Tax calculated for all periods within the tax year. The Portland Oregon sales tax is NA the same as the Oregon state sales tax. Start filing your tax return now.

The minimum combined 2022 sales tax rate for Portland Oregon is. The Oregon sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the OR state tax. Birmingham Alabama at 10 percent rounds out the list of.

Sales tax region name. 2021 Portland Tax Changes Bluestone Hockley Portland Property Management Jul 24 2019 In May 2019 Oregon imposed a new 057 tax on Oregon gross receipts above 1 million that is set to go into effect for 2020. Sunday January 01 2017.

Automating sales tax compliance can help your business keep compliant with changing. No payment is due with the registration form. View City Sales Tax Rates.

The local sales tax rate in Portland Oregon is 0 as of January 2022. Most states have a sales tax ranging between 4 and 7. Portland Tourism Portland Hotels Portland Bed and Breakfast Portland Vacation Rentals Portland Vacation Packages Flights to Portland Portland Restaurants Things to.

Additional measures could be voted on in November 2021 that. TAX DAY NOW MAY 17th - There are -371 days left until taxes are due. Once you have verified you are exempt no.

The Portland Oregon sales tax is NA the same as the Oregon state sales tax. The 2018 United States Supreme Court decision in South Dakota v. This is the total of state county and city sales tax rates.

Did South Dakota v. Wayfair Inc affect Oregon. There are no local taxes beyond the state rate.

To review the rules in Oregon visit our state-by-state guide. Ad Lookup OR Sales Tax Rates By Zip. Multnomah County passed a new measure in May 2021 that will impact property tax payers in Portland in 2022.

Five other citiesFremont Los Angeles and Oakland California. Income Tax Calculator. The minimum Heavy Vehicle Use Tax due for a tax year is 100.

The vehicle use tax applies to Oregon residents and businesses that purchase vehicles outside of Oregon. Powell Butte OR Sales Tax Rate. This great American city has plenty to offer visitors.

View County Sales Tax Rates. Portland Oregons Sales Tax Rate is 0 IRSgov 2021 2. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities.

It would have funded a range of public services including emergency responder. The Portland sales tax rate is. As of 2019 Portland had an estimated population of 654741 making it the 26th.

Corporations exempt from the Oregon Corporation Excise Tax under ORS 317080 generally not-for-profit corporations unless subject to tax on unrelated business income. Oregon law doesnt allow you to reduce your Oregon taxes because you paid sales taxes in another state. Business Registration Everyone doing business in Portland or Multnomah County is required to register.

And Seattle Washingtonare tied for the second highest rate of 1025 percent. The minimum tax would be in addition to the 100 minimum tax described in Section 702545 if applicable. Start filing your tax return now.

The Wayfair decision and online sales tax On June 21 2018 the US. All businesses must register Registration form or register online If you qualify for one or more of the exemptions you must file a request for exemption each year and provide supporting tax pages. The Multnomah County sales tax rate is.

Free Unlimited Searches Try Now. Starting July 1st 2019 Washington has done away from the tax exemptions that were offered to Oregonians who showed their Oregon ID at retail locations. Oregons personal income tax is progressive but mildly so.

Last updated April 2022. Online Services We offer a variety of online services including business registration uploading tax pages filing a returnextension exemptions and payments. The tax would apply to retailers with more than 1 billion in national sales and 500000 in Portland-specific sales.

Has impacted many state nexus laws and sales tax collection requirements. In Newport Measure 21-205 proposed a 5 tax which would have applied to the sale of prepared food and beverages. Historical Sales Tax Rates for Portland.

What is the sales tax rate in Portland Oregon. Information about Portland Business License Tax Multnomah County Business Income Tax and Metro Supportive Housing Services. While many other states allow counties and other localities to.

Supreme Court ruled a state may collect sales tax from taxpayers located outside the state if they are selling to state residents and there is a sufficient connection. Portland Tourism Improvement District Sp. The County sales tax rate is.

Post OR Sales Tax Rate. Portland OR Sales Tax Rate.

Oregon Enacts Two New Local Income Taxes For Portland Metro Multnomah County Primepay

City Guide Portland Oregon Go Next

The Top 10 Reasons To Move To Portland Or Home Money

Property Tax Bills To Be Mailed This Week At Least Small Increases In Store For Most In Portland Metro Oregonlive Com

/shutterstock_178351457-5bfc365646e0fb00517e18e7.jpg)

Taxes In Oregon For Small Business The Basics

Take Your Pick From Over 5 Different Travel Itineraries Stay In Wilsonville Just 16 Miles South Of Portland Video In 2021 Fun Family Trips Travel Fun Wilsonville

How To Plan The Ultimate 3 Day Weekend In Portland Oregon Postcards To Seattle

Oregon State 2022 Taxes Forbes Advisor

Best Airbnbs In Portland Oregon 19 Top Places To Stay In 2021 Magical Vacations Travel Vacation Trips Oregon Travel

Portland Or Travel Guide U S News Travel

Portland Oregon Travel Guide At Wikivoyage

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Oregon Minimum Wage In 2022 Square

Cost Of Living In Portland Or Upnest

Singing Christmas Tree Portland Singing Christmas Tree Downtown Portland Portland

20 Honest Pros And Cons Of Living In Portland Oregon Tips

16 Best Things To Do In Portland Oregon Conde Nast Traveler

Portland Oregon Learn About Life In And Around Portland Or Usa Pela